How to Make Money: Embrace AI Agents, AI Bots, and Automation for Financial Success

How to Make Money: Embrace AI Agents, AI Bots, and Automation for Financial Success

Estimated reading time: 7 minutes

Key Takeaways

- AI Bots enhance efficiency in business operations.

- AI Agents analyze data for better decision-making.

- Automation reduces operational costs significantly.

- Utilizing these technologies can lead to profitable revenue streams.

- Always approach money-making strategies with realistic expectations.

Table of Contents

The Evolution of Money-Making Strategies

In today’s fast-paced digital economy, the phrase “Make Money” has taken on new meanings. With innovative technologies emerging, individuals and businesses are finding creative ways to generate income. This post focuses on how AI Agents, AI Bots, and Automation are revolutionizing the landscape of making money.

Traditional Methods of Making Money

Historically, people generated income through various traditional means:

- Job-Based Income: Most individuals relied on stable employment, earning a paycheck for their work.

- Brick-and-Mortar Businesses: Entrepreneurs established physical stores to retail products and services.

However, the rise of the internet and technological advancements has reshaped these strategies.

The Shift to Digital Income Streams

The digital age has introduced new pathways for income generation, making it easier to “Make Money”. According to a recent article, technology has revolutionized income opportunities by providing access to online platforms that enable individuals to earn more flexibly.

Harnessing Technology to Make Money

As we venture further into the modern world, technology plays a crucial role in money-making ventures. One standout technology is AI Bots.

What Are AI Bots?

AI Bots are automated software applications that utilize artificial intelligence (AI) to perform tasks without needing human input. They can accomplish various tasks, from managing online sales to customer service inquiries, increasing efficiency and reducing costs.

How AI Bots Help Businesses

Many businesses have integrated AI Bots for diverse purposes, leading to enhanced profit margins:

- E-commerce: AI Bots can recommend products based on customer preferences, driving sales.

- Customer Support: They can answer frequently asked questions, providing quick responses to users.

For instance, a popular online retail company has effectively used AI Bots to automate customer inquiries, increasing customer satisfaction and driving revenue growth. By leveraging AI Bots, businesses can streamline operations while maximizing their earning potential.

Exploring AI Agents for Income Generation

While AI Bots are essential tools in today’s market, AI Agents represent the next step in technological evolution.

Understanding AI Agents

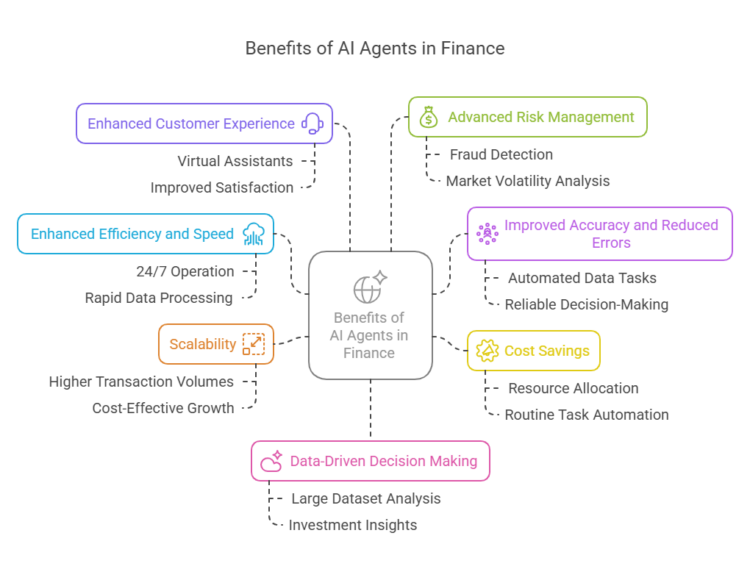

Unlike AI Bots, AI Agents have decision-making capabilities, enabling them to analyze data and make informed choices. This advancement allows AI Agents to perform more complex tasks and create diverse revenue streams.

Applications of AI Agents

AI Agents are transforming many sectors:

- Trading: Automated trading software uses AI Agents to analyze market trends and execute trades, potentially increasing returns for investors.

- E-commerce: AI Agents can optimize product listings based on data, leading to higher sales conversions.

- Customer Service: They can predict customer needs and tailor responses for better engagement.

To see how AI Agents are crucial in revolutionizing business operations, visit this resource here.

The Power of Automation in Business

Next, let’s consider Automation as a technique to enhance business operations and profitability.

What is Automation?

Automation refers to the use of technology to execute tasks with minimal human intervention. This practice optimizes processes, reduces errors, and saves time.

Benefits of Automation

Integrating automation into a business can yield significant advantages:

- Efficiency Gains: Businesses can streamline operations, allowing employees to focus on strategic initiatives rather than repetitive tasks.

- Cost Savings: By reducing labor costs and increasing output, automation can drastically impact profitability.

Case Studies on Successful Automation

Numerous companies have embraced Automation to drive revenue growth. For example, a well-known manufacturing firm implemented automated processes in its production lines, which resulted in a 25% increase in output and a significant reduction in operational costs.

To delve deeper into how businesses are leveraging automation, check the insights here.

Utilizing n8n for Automation

As we explore automation tools, one powerful option is n8n.

What is n8n?

n8n is a versatile tool for automating workflows to create efficient processes aimed at enhancing revenue.

Getting Started with n8n

Follow these steps to set up n8n:

- Create an Account: Start by signing up on the n8n website.

- Connect Your Apps: Integrate applications you frequently use (e.g., email, e-commerce platforms).

- Design Workflows: Utilize n8n’s interface to create workflows that suit your money-making strategies.

Sample Automation Workflows

Examples include:

- E-commerce Notifications: Automatically send email alerts for sales or stock updates to keep customers informed.

- Data Analysis: Collect and analyze sales data from various platforms to gain actionable insights.

Testing and Scaling

Beginners should test simple automations before expanding their workflow complexities. As experience grows, you can implement more intricate processes to maximize profits.

For more details on using n8n, visit n8n’s official website.

Real Life Case Studies and Testimonials

To truly understand the impact of AI Bots, AI Agents, and Automation, let’s explore real-life examples.

Success Stories

- Freelancers and Online Entrepreneurs: Many individuals have utilized AI Bots for customer service, allowing them to focus on creating high-quality content while bots handle inquiries. This approach has led to increased revenue.

- Small Businesses: Entrepreneurs using AI Agents to analyze market data have significantly improved their profit margins by making data-driven decisions.

Sharing the experiences from various sectors underscores that these technologies are not just theoretical; they can lead to financial independence for dedicated users.

Conclusion

In conclusion, the methods to Make Money have vastly evolved from traditional approaches to technology-driven strategies. Leveraging AI Bots, AI Agents, and Automation provides insightful opportunities for generating income in the digital age. While the potential for earnings is promising, it is essential to maintain realistic expectations about how quickly these strategies can become profitable.

Additional Resources

To expand your knowledge and improve your strategy for making money, here are some valuable resources:

- n8n for Automation: Learn how to effectively use n8n for automation here.

- Understanding AI Bots and AI Agents: Further reading on the power of these technologies here.

- Automation Strategies: Resources outlining effective methods for making money through automation here.

By following these guidance points and embracing today’s technology, you can embark on your journey to successfully “Make Money” in a new era of economic opportunities.