Computer Automation: How It’s Reshaping Industries and Boosting Efficiency

Computer Automation: Transforming the Future of Work

Estimated reading time: 7 minutes

Key Takeaways

- Computer Automation is critical for streamlining tasks across various sectors.

- This technology aids in improved efficiency and reduces operational costs.

- Understanding automation’s benefits and challenges is essential for successful implementation.

- The future of work will increasingly rely on automation combined with AI technologies.

Table of contents

What is Computer Automation?

**Computer Automation** refers to the application of computer software, electronics, and programming to control processes and replace manual work. It encompasses a range of automated tasks, such as:

- Workflow Automation: Managing the flow of tasks between people and systems to ensure smooth operations.

- Robotic Process Automation (RPA): Mimicking human actions within digital environments to perform routine tasks.

- Intelligent Automation: Combining artificial intelligence (AI) with traditional automation for better decision-making.

Examples of automation tools include automated email alerts, AI-driven invoice processing, and predictive maintenance systems. These technologies save time and reduce the burden of repetitive tasks, freeing up human resources for more strategic roles. Source Source

Current Trends in Computer Automation

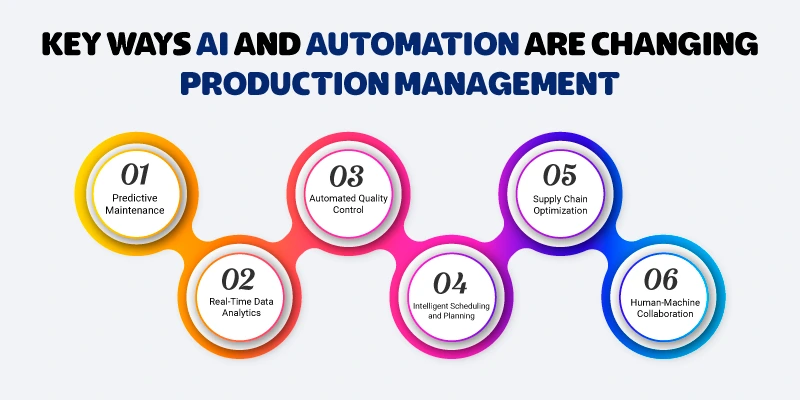

The realm of computer automation is continuously evolving. Here are some of the latest advancements reshaping industries:

- No-Code and Low-Code Automation: These platforms empower users to automate processes without needing extensive programming skills, democratizing access to automation.

- Hyper-Automation: This trend integrates multiple technologies for end-to-end automation of entire business functions. Sectors like manufacturing experience hyper-automation by streamlining operations across various departments.

- Natural Language Processing and Chatbots: These technologies enhance customer service by enabling more sophisticated interactions between users and machines.

The move from traditional methods to modern automated approaches brings substantial benefits. For instance, in manufacturing, automated inventory management can significantly speed up the supply chain and improve accuracy. Source Source

Benefits of Computer Automation

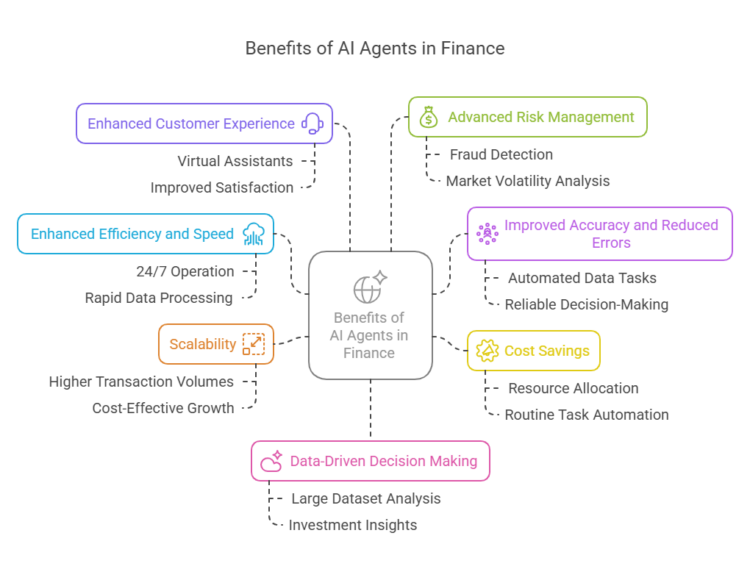

Adopting computer automation can lead to several significant advantages:

- Increased Operational Efficiency: Automation accelerates processes, allowing businesses to operate at higher speeds with less effort.

- Cost Reductions: By minimizing the need for manual labor, organizations can cut down on operational costs.

- Enhanced Accuracy: Automated systems minimize human error, enhancing overall reliability.

Several case studies illustrate the effective use of automation:

- In banking, automation simplifies loan processing and transaction reconciliation.

- The healthcare sector benefits from automation through digital patient records and streamlined claims processing.

- Manufacturing firms employ predictive maintenance systems, reducing downtime and extending equipment lifespan.

These examples show how embracing automation can yield substantial improvements in productivity and effectiveness across various sectors. Source Source

Challenges and Considerations

While computer automation presents numerous benefits, businesses may face challenges during implementation:

- Training Employees: It is essential for staff to adapt to new automated systems, which requires proper training and support.

- Integration with Existing Systems: Smooth integration of automation within current operations is crucial to avoid disruptions.

- Data Security: Organizations must address concerns regarding privacy and security to protect sensitive information.

Understanding the nuances of job displacement versus job transformation is also vital. While automation may replace some roles, it also transforms existing jobs, focusing more on strategic thinking rather than repetitive tasks. Furthermore, although fully autonomous systems can be costly, simpler workflow automations often yield quicker return on investment (ROI). Source Source

Future of Computer Automation

Looking ahead, the future of computer automation seems brighter than ever. With ongoing advancements in AI and machine learning, we can expect transformative changes across industries.

- Continual AI Integration: As AI technology matures, it will drive deeper automation and lead to smarter applications that can handle increasingly complex tasks.

- Impact on Jobs and Skills: As automation continues to evolve, there will be a growing demand for new skills. Workers will need to adapt and refine their capabilities to thrive in an automation-driven landscape.

Engaging with these developments will be crucial for organizations and individuals alike. By embracing automation advancements, industries can position themselves for sustained growth and efficiency. Source

Conclusion

In this blog post, we explored the concept of computer automation and its influence on various sectors. We examined its benefits, including increased efficiency, cost reduction, and enhanced accuracy. We also addressed challenges, such as the need for staff training and data security.

As the automation landscape continues to evolve, it’s essential for professionals to stay informed. By understanding and leveraging automation tools, organizations can harness their potential to enhance productivity and drive success.

Consider exploring how automation can fit into your operations. The opportunities to improve efficiencies and make technology work harder for you are significant.

Additional Resources

For those eager to dive deeper into computer automation, here are some valuable resources to further your understanding:

- Books: Look for titles that cover automation technologies and methodologies.

- Articles: Websites like FlowForma and Shopify offer extensive insights into automation applications.

- Tools and Software: Explore tools recommended at Vegam for initiating your automation journey.

Embarking on your automation journey can greatly enhance your operational processes and future-proof your business. Happy automating!

Frequently Asked Questions

What does computer automation involve?

It involves the use of software and technology to automate tasks, minimizing the need for human intervention.

What are some common applications of automation?

Applications include workflow automation, robotic process automation (RPA), and intelligent automation.

How can automation benefit my business?

Automation can improve efficiency, reduce costs, and enhance accuracy, among other benefits.

What challenges might I face with automation?

Challenges include employee training, system integration, and ensuring data security.

How is the future of work impacted by automation?

The future of work will increasingly rely on automation and AI, creating a demand for new skills and job roles.